Overview

Swift W4 app for SAP S4HANA streamlines Form W-4 management for US businesses, automating completion and updates for accurate tax withholding. Form W-4 is an IRS tax form for employees to declare their tax situation to employers, ensuring correct federal tax withholding.

The Swift W4 App provides the following key features:

Note: You need Swift platform service to use this application.

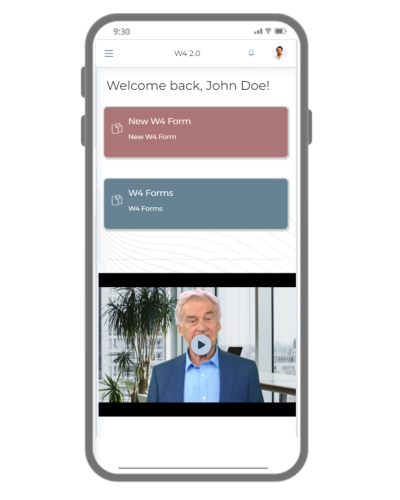

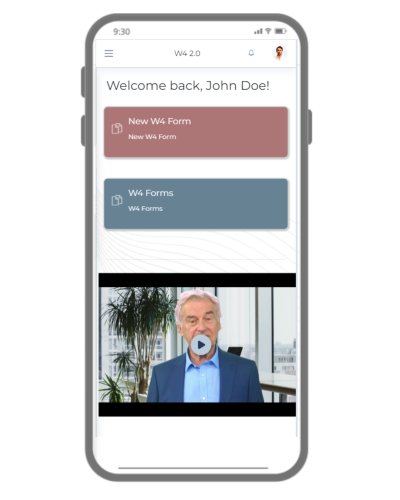

Dashboard

The Dashboard View in W4 form features a user-friendly Interface.

- Equipped with essential widgets, like “NewW4 form” and “W4 form” widgets, providing valuable insights and allowing seamless access to relevant forms.

- Additionally, users are greeted with a welcoming note upon accessing the app, accompanied by a concise video tutorial on how to effectively utilize its features.

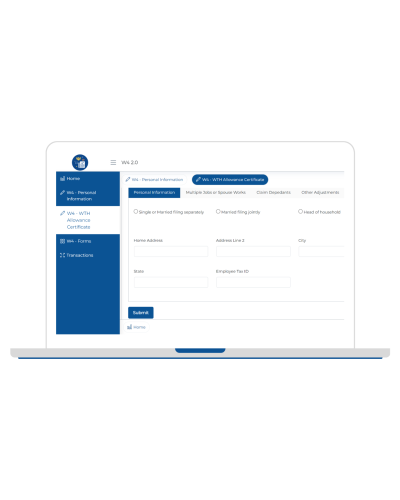

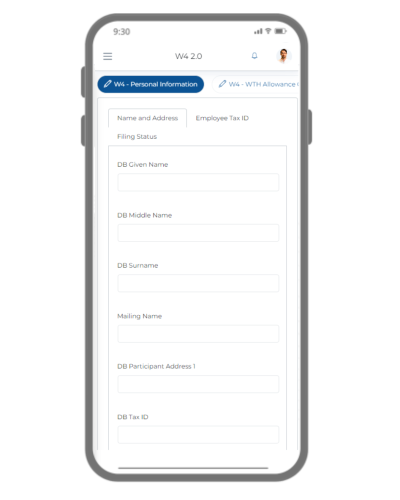

W4 – Personal Information

The W4 – Personal Information entry form within the Swift W4 app allows users to input vital details necessary for precise tax withholding.

- This includes essential information such as the individual’s full name, current address, social security number, and filing status.

- By meticulously collecting these details, the app ensures adherence to IRS regulations and facilitates smooth processing of tax-related matters

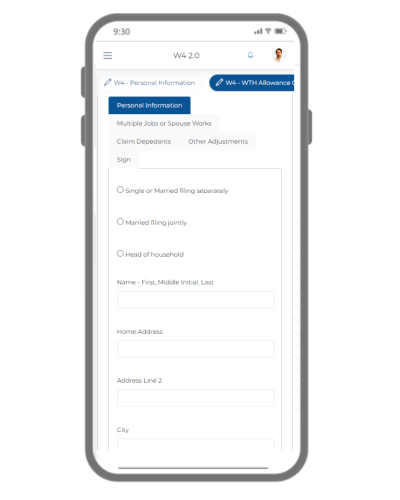

W4 – WTH Allowance Certificate

The W4 – Withholding Allowance Certificate entry form in the Swift W4 app enables users to declare their withholding allowances accurately.

- Users can specify allowances for themselves, spouse, dependents, and additional income, ensuring precise tax withholding calculations.

- This streamlined process ensures compliance with IRS regulations and facilitates efficient management of tax responsibilities.

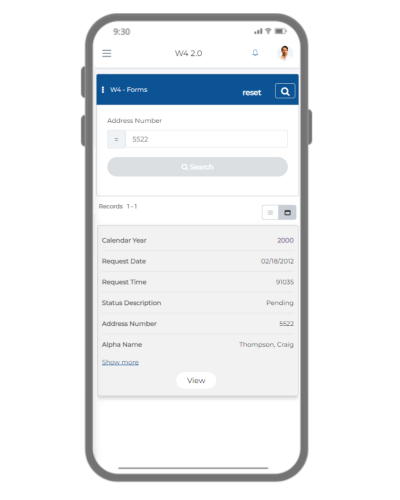

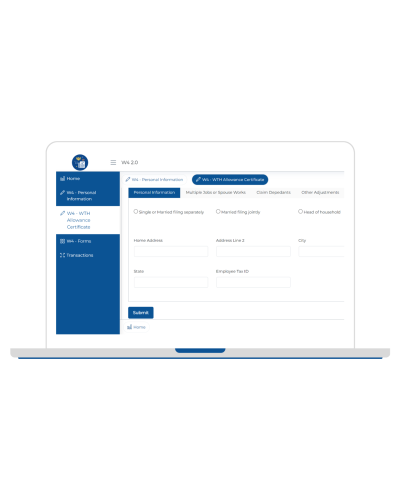

W4 Forms

The Form W-4 browsing feature in the Swift W4 app allows users to easily locate and access the W-4 form issued by the IRS.

- Users can quickly find the latest version of the form, ensuring compliance with current regulations.

- This convenient browsing capability streamlines the process of accessing essential tax documents, facilitating efficient tax management for businesses and employees alike